The private debt asset class has become increasingly important as a financing solution for both private equity sponsors and corporates. In fact, it has positioned itself as one of the fastest growing products within the global private market landscape. As a result, money raised by private debt funds has reached record levels in recent years, not only through the direct lending strategy, but also through opportunistic and niche strategies such as distressed debt and special situations.

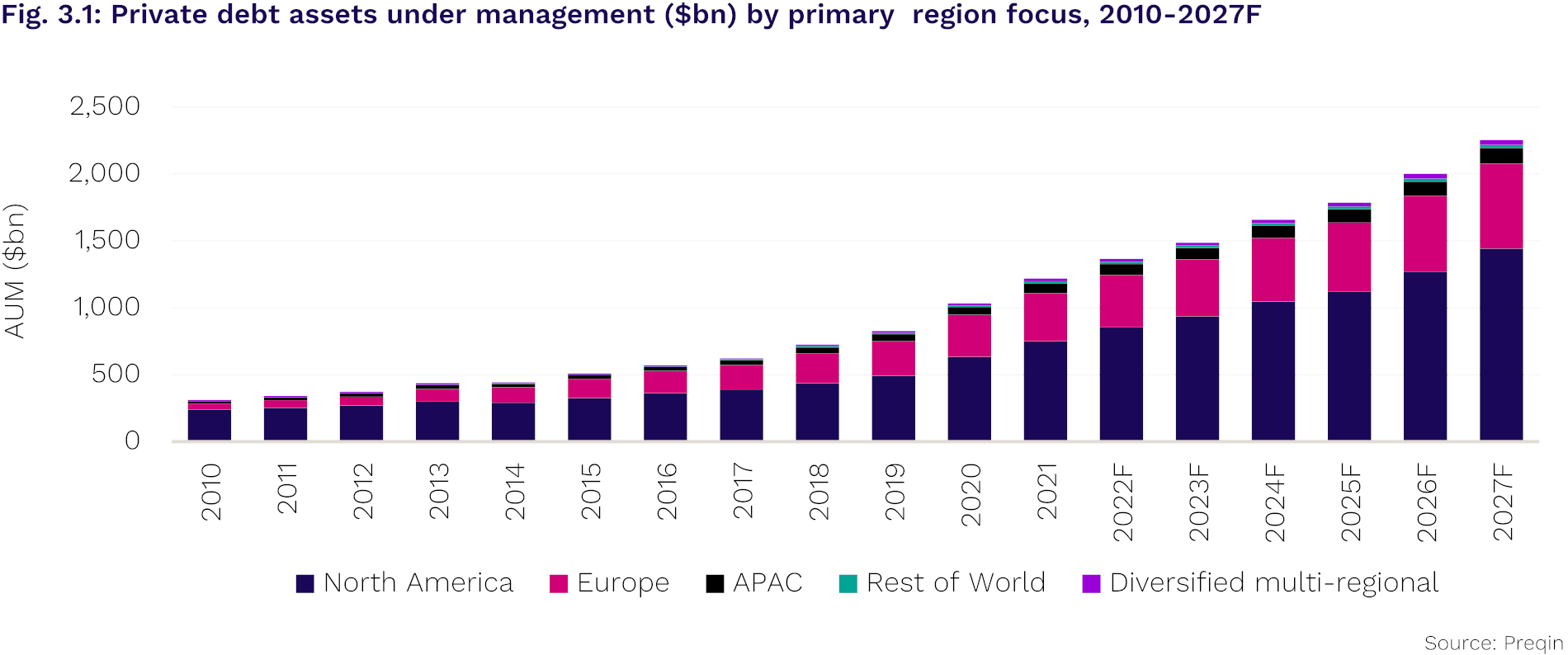

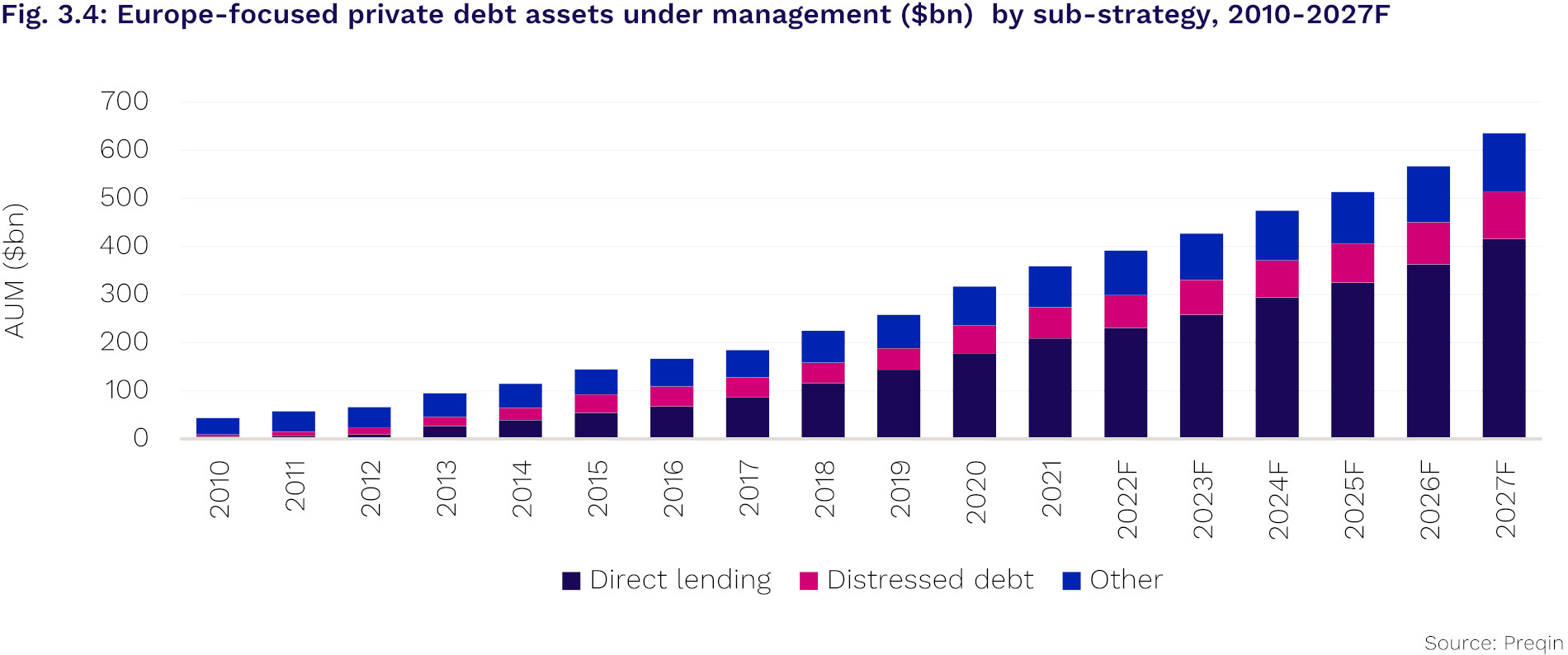

Since its inception, the private debt market has withstood a series of economic turbulences and the pandemic has only accelerated the growth trend. Even against the current backdrop of a weaker macroeconomic environment triggered by geopolitical tensions, global energy transition, and tighter monetary policy worldwide, the market is proving resilient and attractive. This is also confirmed by the current forecasts of the investment data company Preqin, which predicts that the asset class will grow to a global market volume of 2.3 trillion US dollars by 2027 (including a Europe-wide volume of approx. 600 billion US dollars).

Staff recruitment increasingly difficult

The private debt industry has grown significantly in recent years: international funds are increasingly entering the German market, opening new branches and are setting up new structures – a consistent trend even in view of a higher interest rate environment. Even though the current economic situation and the likely imminent recession is dampening this growth in the short term, the long-term forecast for the asset class is by no means weak. Quite the contrary: The private credit product is not only well established, but it has become such an integral, indispensable part of the financing world that we expect further structural growth of the asset class and its associated investment and fundraising teams.

Organisations that initially commenced their DACH activity with a “head of” role and a VP, often followed by one or two associates, are now confronted with a senior-heavy team that leaves room at more junior levels. Furthermore, growing fund volumes and investment opportunities lead to a higher workload, which has to be met by an increase in headcount. Consequently, we are seeing a type of maturation or institutionalisation of private debts’ human capital base, which is now confronted with issues such as title structure and career development. Furthermore, lateral hirings are also becoming increasingly relevant in order to drive change quickly and effectively at the mid- to senior level.

Special challenge in personnel strategies

However, despite growing demand, there are complex challenges in recruitment: As a niche industry, private debt firms in Germany are still less well-known than their more established private equity counterparts. This is a predicament often encountered when talking to the younger generation. A majority of graduates prefers to enter the M&A space rather than the field of leveraged finance. Reasons for this are multifaceted: On the one hand, credit career paths are less prominently discussed at university, but also at later stages in the career cycle many are not aware of the potential for success that this sector holds.

However, the private debt world often draws talent from the leveraged finance teams of banks or debt advisory boutiques, which – as just described – face major challenges in sourcing sufficient staff. Against this background, the private debt world is confronted with overall structural staff shortage. Solutions to the bottleneck could possibly lie in more flexible profile requirement or a greater willingness to invest in the training of young high potential talent.

Despite the structural deficit, the requirements for candidates in the private debt sector are still high: Organizations seek experienced credit professionals and high potential candidates who are self-motivated, have strong analytical skills, and a sound professional as well as personal grounding. Furthermore, it is essential to demonstrate well-honed commercial acumen, which should enable the prospective investor to think (far) outside the box of the basic banking credit process. Empathy and a penchant for networking round off the profile.

Diversity and incentives

Diversity also plays a major role, just like in private equity. However, the proportion of women is still many times lower than in PE, which is due to the fundamentally smaller candidate pool. Based on our statistics, the cumulative share of female DACH candidates in the private credit, debt advisory, leveraged and structured finance pools is around 15% – nowhere near enough to ensure parity. This is another indicator that female students are still not being mobilised successfully enough for the world of finance and that much more should be invested in relevant initiatives.

Within the narrow candidate pool, further challenges arise: As the market is competitive, most candidates – both male and female – often have several offers on the table and attractive development opportunities. Furthermore, carry commitments anchor strong candidates, which makes them even more difficult to convert. Offers must therefore be structured in an increasingly generous way; in times of high inflation even more competitively than before. For younger candidates it is not only the financial aspect, but also flat hierarchies, short decision-making processes, development opportunities, and early carry participation that move the needle. On the part of the funds, it is thus important to exemplify a culture of partnership and to be able to design credible and concrete development paths at an early stage.

About the authors:

Britta Bene is a strategy consultant specialising in asset management. She founded Mainstay Human Capital Advisors in 2021, a human capital advisory firm specialising in private markets with a focus on the Northern European region. The portfolio of services includes finding specialised executives, advising and supporting companies in organising their human capital structures, as well as in the composition of advisory boards. Bene has also been a board member of the Bundesverband Alternative Investments e.V. (BAI) since 2020.

Cornelia Keßler joined the Mainstay team as a strategy consultant in October 2021 and specialises in private markets mandates in the DACH region, which include investment and sales functions in the areas of private equity, venture capital, infrastructure, and private debt.