Hardly any women, hardly any ethnic minorities, few socially disadvantaged people – A recent UK-study shows how much the financing success of young companies depends on the socio-economic background of their founders. more…

Fund Formation 2021 – German law at a glance

Learn more about the rules applicable in Germany for setting up private equity funds with a focus on the choice of vehicle, the formation process, regulation, licensing and registration, taxation, including relevant tax treaties, sales restrictions, listing considerations, participation in private equity transactions, and remuneration and profit-sharing issues. . more…

Corporate Tax 2021 – Current developments in German law

Learn more about the key features of the German tax regime, e.g. the taxation of inbound investments, the taxation of non-local corporations, the fight against tax avoidance as well as the tax implications of corona-related state aid. more…

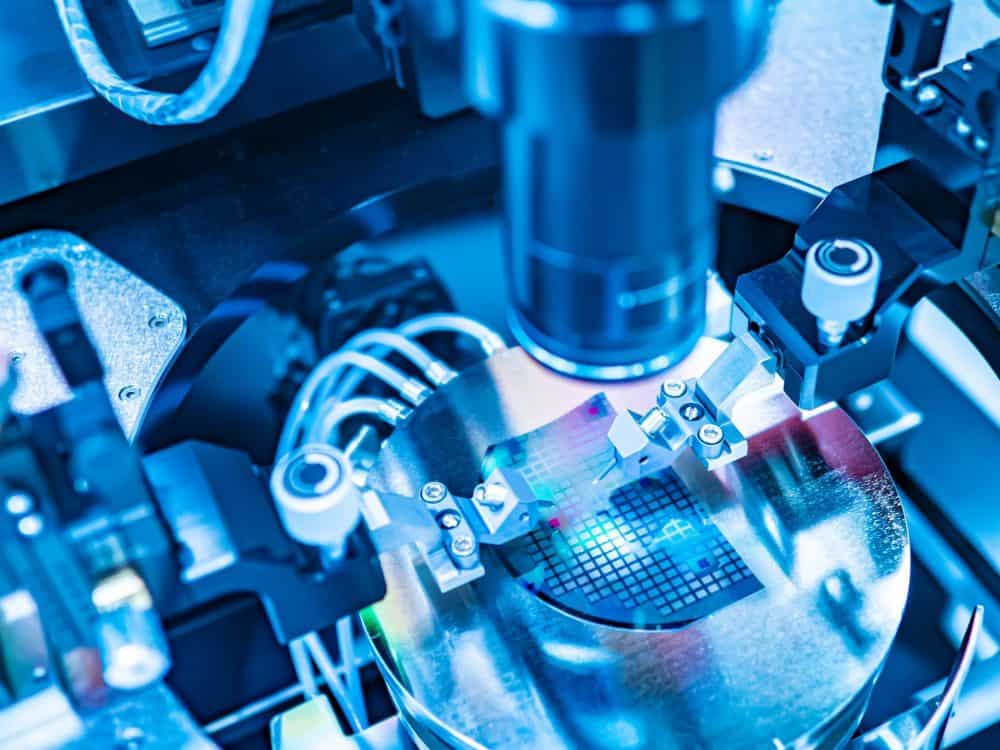

Investment control – 17th FTO amendment brings further expansion of notification requirements

On 27 April 2021, the German Federal Government passed the 17th Ordinance amending the Foreign Trade Ordinance (the 17th FTO Amendment). This is intended to conclude the reforms of Germany’s national investment control legislation that began in the year 2020. In focus: The notification requirements will be extended to 16 additional economic sectors, especially in the high-tech sector. more…

Software License Agreements in the M&A Transaction

Almost every company is dependent on software. If the software has not been created by the company itself, it must be licensed from third parties. The legal basis for this is a so-called software license agreement. In this article, PE-Magazin-author and attorney-at-law Christine Funk deals with the importance of software license agreements in M&A transactions and shows which particularities have to be considered. . more…

Corporate Governance 2021 – Current developments in German Corporate Law

Ongoing reforms and the continuing challenges posed by the Corona pandemic are having an impact on German corporate law. PE Magazin author Dr Eva Nase provides an overview of current developments. more…

Corporate Human Rights Responsibility – Why a strong Supply Chain Act is important

While many companies recognize they have a responsibility to ensure respect for human rights in their global supply chains, there is no law in Germany or the European Union mandating companies to establish such human rights due diligence. This may change soon. more…

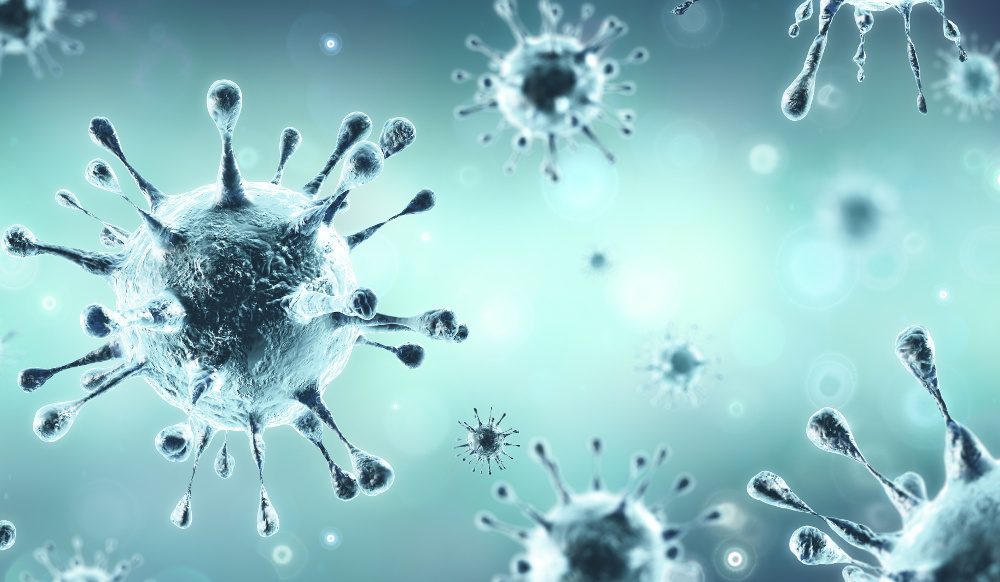

Duty to test, tax relief, insolvency law – The new German Corona rules at a glance

The Corona pandemic continues, and the federal government is reviewing the current relief measures accordingly. In tax law in particular, existing relief will be extended, and it will also be possible to write down certain assets more quickly. In our Corona News Update, you can find out what other rules need to be observed. more…

Customized software in the M&A Transaction

Driven by advancing digitalization, technologized or digitized processes, primarily through the use of software, have become an integral part of everyday business life. However, the resulting legal implications are often unrecognized or underestimated. In the following, PE-Magazin-author Christine Funk explains the particularities that need to be taken into account in practice for M&A transactions whenever the company to be acquired has customized software. more…

Brexit – New rules for data transfer between companies

Data transfer with the United Kingdom (UK) plays an important role for some companies. This is the case, for example, when data is transferred within a group of companies to affiliated companies in the UK or to other third parties in the UK (e.g. when using a UK cloud). PE-Magazin-author Christine Funk outlines what now has to be considered when transferring data to the UK. more…

Websites, Domains and Social Media in the M&A Transaction

Websites, domains and social media are at the heart of the Internet. But how can they be legally classified? And what are the consequences for an M&A transaction in which websites, domains and/or social media are an essential part of the business object of the target company? In the following article, PE-Magazin-author Christine Funk provides an overview of the most important issues in this context. more…

How to navigate EU Marketing from the UK

Brexit has also changed the distribution requirements for UK fund managers in the EU. PE-Magazine author Sebastian Käpplinger talks about this to Rachel Fenwick (LaSalle). more…

BVK figures 2020 – German private equity market defies Corona

In 2020, the German private equity market proved its resilience to the crisis – Despite the global corona pandemic, investments remained at a consistently high level. more…

FüPoG II – Federal government takes aim at “women’s quota” again

In order to increase the proportion of women in German boardrooms, the federal government is introducing an extension of the existing legal situation. New features include a minimum quota and stricter sanctions. more…

COVID-19 Update – New regulations in company, insolvency and tax law

The corona-related relief in German company, insolvency and tax law is going into overtime. Read our news update to find out everything you need to know about the applicable deadlines and requirements. more…