Definition and structure of a Managed Account

The Managed Account (also called Separately Managed Account) is a form of an investment in which an investor mandates a third party with the management of the investor’s (trading) account. The asset manager intends to generate profits for the investor’s account. The investor may grant the asset manager a limited or comprehensive power of attorney to implement an agreed investment strategy.

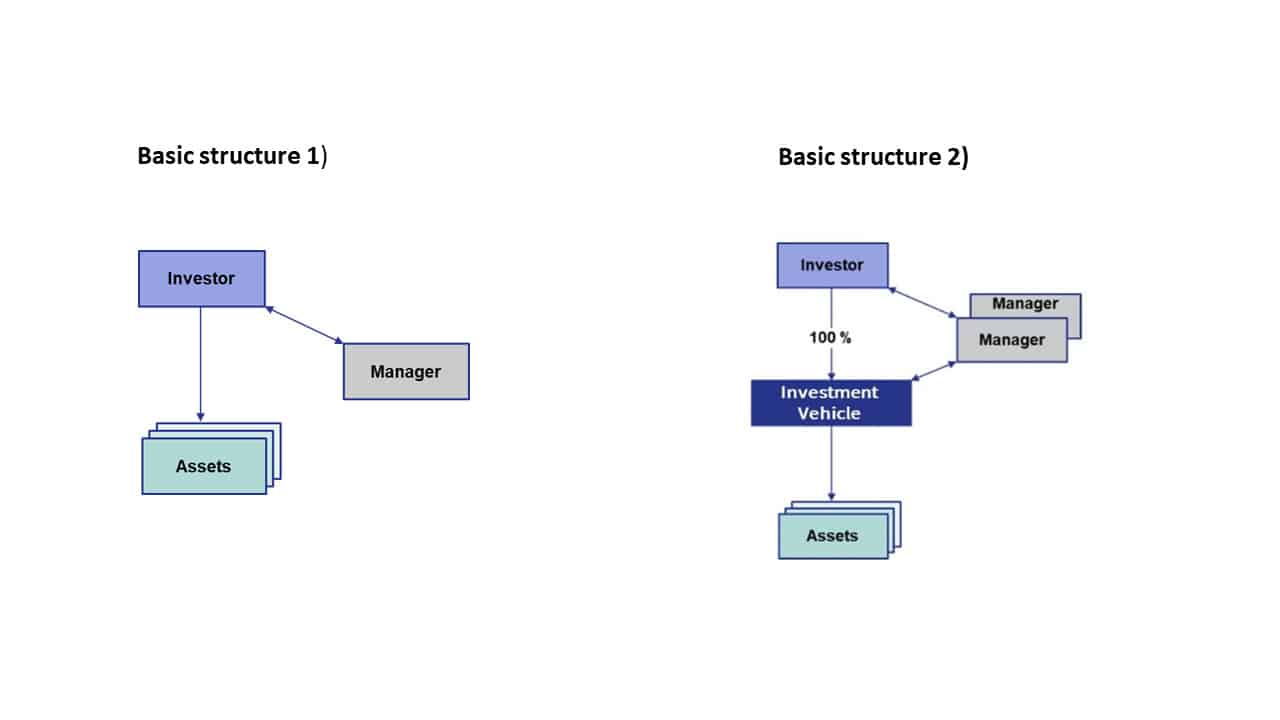

The following (basic) structures exist:

The basic structure 2) is more common among institutional investors. The advantages over the basic structure 1) include the generating of consolidation effects at the level of the investment vehicle, the establishment of tax-optimised structures and a limitation of liability due to the investment vehicle. One of the disadvantages is the additional organizational and cost level.

The basic structure 1) has the benefit that the investor as owner of the assets is able to exercise direct control. Further, the investor is mainly independent of the asset manager. The disadvantages include, inter alia, (i) the direct liability of the investor in respect to the assets and (ii) the fact that the assets are to be accounted for the investor’s balance sheet. In addition, tax disadvantages in relation to the management (value added tax and carried interest) may emerge.

Advantages and disadvantages of a Managed Account compared to an Investment Fund with several investors

The upsides of a Managed Account are based in particular on the fact that the investor is not exposed to the interests of other investors. This includes the following points:

- high flexibility (e.g. the definition of the term and cost structure),

- the investor has direct control and influence (e.g. on the investment strategy and portfolio structure).

In addition, there are fewer regulatory requirements for a Managed Account as the German Investment Code (Kapitalanlagegesetzbuch) is not applicable. Thus, neither a manager of alternative investment funds (AIFM) nor a depositary is required.

A downside of a Managed Account could be the additional organisational effort for the investor (e.g. due to the independent exercise of rights by the investor).

Aspects in the structuring of an investment

When structuring an investment vehicle, the following points among others have to be taken into account: the applicability of the Investment Tax Act (Investmentsteuergesetz), the German Investment Code (Kapitalanlagegesetzbuch), the Insurance Supervision Law (Versicherungsaufsichtsgesetz), double taxation treaties and the German Commercial Code (Handelsgesetzbuch)/IFRS.

In addition, the following points are relevant:

- reporting obligations of the investor,

- the investment process,

- appointment of an investment advisor,

- regulatory and tax issues,

- term and size.

Common legal forms of investment vehicles

In Germany, the limited liability company (GmbH), the limited partnership structured as GmbH & Co. KG and the special investment fund (Sondervermögen) are frequently used investment vehicles. In Luxembourg, the Société en Commandite Spéciale (SCSp), Société en commandite par actions (SCA) and the Société anonyme (SA) are quite common legal forms.

Depending on the legal form of the investment vehicle, the following aspects are associated with such choice:

- requirement of an AIFM and a depositary,

- flexibility in the drafting of contracts,

- regulatory requirements – such as Solvency Capital Requirements (SCR) under Solvency II,

- requirements in accordance with the Ordinance on the Investment of Restricted Assets of Insurance Undertakings (Anlageverordnung) and the Insurance Supervision Law (Versicherungsaufsichtsgesetz),

- additional level of taxation, trade tax and dry income risks, tax (non-)transparent structure.

Summary

The structuring of an investment as a Managed Account may be an attractive option for an investor. Primarily, it offers a high degree of flexibility, as fewer investment regulations apply and no coordination with other investors is required. Within the framework of a Managed Account, an investor can therefore choose a structure that is solely tailored to his needs. When choosing a specific structure, many factors have to be taken into account, including regulatory and tax law.

This article was written as part of the MUPET 2019. Learn more about Munich Private Equity Training.